Software Review

iCash 3.0.3

Developer: Maxprog

Price: $39 (as of writing, on special for $30)

Requirements: Mac OS 9 or Mac OS X

Trial: Fully-featured (30 days)

Looking for a cheaper alternative to home finance heavyweights like Quicken and Microsoft Money? With iCash, you can chart everything from checking accounts to your 401(k) to the bills in your wallet, but spend less green doing so. You can import and export in a variety of formats (including Quicken and Money), easily report on spending categories, and do budgeting without jumping from a check register to a spreadsheet and back.

Installation

It’s very easy to download and install iCash from the Maxprog site. In Mac OS X, installation creates a folder in your Applications folder that contains the main application and its support files. When you have questions, you can refer to the manual from the installation directory. (There’s also an online version, which may get updated more often.)

Features

You can manage any kind of financial transaction in iCash (any I could think of, anyway: checking accounts, salaries, tax refunds, and so on). Transaction categories can be as specific as you want—iCash itself comes with things like “auto fuel” and “home maintenance.” Connecting a transaction to a category tracks where you’re spending the money, and on what. (Of course, maybe you don’t want to know.) The pre-defined categories cover most options, but maybe you want to know how much went to something more esoteric, like eBay.

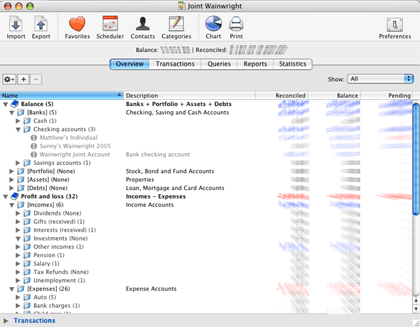

The iCash screenshots page shows the program’s interface well. One slight difference is the tab bar above the account register. For version 3.0.3, it lacks the “Accounts” tab. (My own screen shot is below for comparison, with money amounts blurred.)

In the main window, the categories and accounts expand and collapse in an outline structure. Click a triangle to toggle, or double-click to change its name. Select the Transactions tab instead to see all income or debits for the selected account. The Pending column shows the amount of transactions that haven’t “cleared.” You can verify or reconcile them from the Transactions tab, as well.

Recording Transactions

Transactions have types (such as cash, charge, or billed), an “origin” account (such as your checking account), and a “target” account (such as the cable TV bill). Use the pop-up lists to pick one or type in a few letters to see matching previous entries. (If you’re tracking business expenses, you’ll also need the invoice and taxes fields.) Add the transaction once you’re done.

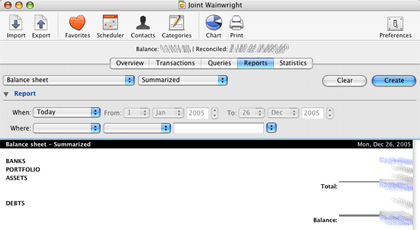

Reporting on Transactions

Reporting on finances makes the world go around and sells a lot of papers. It’s also easy to do in iCash. Select the Reports tab to assemble data by time range or account.

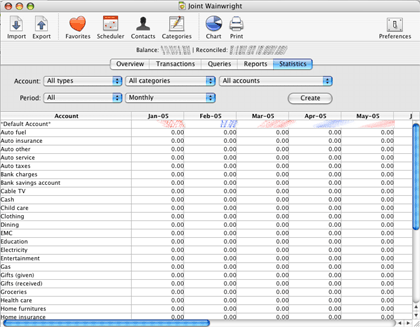

If you want to report by expense type instead, use the Statistics tab. This view creates a report by month for all categories. Since I collect sports memorabilia, it helps to know I still spend more money on, say, food and shelter.

Usage Notes

When you first open iCash, you name a new “master account,” which is basically the box you keep everything in. Unless you keep separate finances for each iCash user, you only need one to track everything, since it can hold any number of “real” accounts.

The program seems cluttered at first look, since iCash opens directly into the main window, a cascade of folder icons. The top-level folder, Balance, has the financial accounts; and Profit and Loss mark the transaction categories. In Quicken, you usually pick a category by typing in part of a type, which it fills in for you. In iCash, you pick it as the “target account” in a transaction window. (This wasn’t immediately obvious for me.)

Importing data from my bank’s online service was no problem. I exported everything in a supported format, ran an import, and each transaction appeared as expected. Some had cryptic names, though. Fortunately, you can change the name to something more useful in the transaction log. Later on, iCash will use your updated name when it imports something with the same transaction comment.

Should You Stop Using a Checkbook?

I moved to iCash from Quicken, where you typed everything into a virtual checkbook register. If you’re still using paper and pen, there’s a lot of benefit in skipping the math and easily categorizing where your money goes. It really does make a difference in time spent.

Should You Stop Using Quicken or Money?

This is tougher. If you’re comfortable with an existing program, I doubt iCash will sway you away. Its target market appears to be the people who don’t want to pump more money into the coffers of multinational corporations that already have plenty.

If you rely on spreadsheets or something similar that does math for you, but still requires a lot of hand entry, iCash is a reasonable option. It’s been through a few versions, has decent online support, and isn’t bad to use once you adapt to the visual clutter.

Annoyances

There’s a lot more clicking in iCash than there has to be. Moving across a half-dozen fields for each transaction is visually tiring, what with all the buttons and pop-up lists. It gives an impression of managing a database, rather than a checkbook or register. Even if the contents end up in a database, it would feel more natural to have a single-transaction interface for things like a checking account.

Perhaps it’s Macintosh heresy, but it’d be nice to have a more keyboard-friendly transaction mode. In everyday, add-a-check-to-the-ledger use, there aren’t many things to organize and click. Tabbing across a few fields and hitting Return for entry would be more usable.

Bugs

Every now and then, changing the width of columns in the Transactions tab would pop up an error window with an inscrutable message. No data was lost, so it didn’t hurt me, but it could be worrying for most users.

Summary

This is an application with good features but only an average interface. It has a lot of power in an inexpensive package, but could do with a transaction-oriented facelift. If you’d like to manage your finances in something other than a spreadsheet but don’t want to pay Quicken or Microsoft Money, iCash is a good alternative.

Reader Comments (0)

Add A Comment